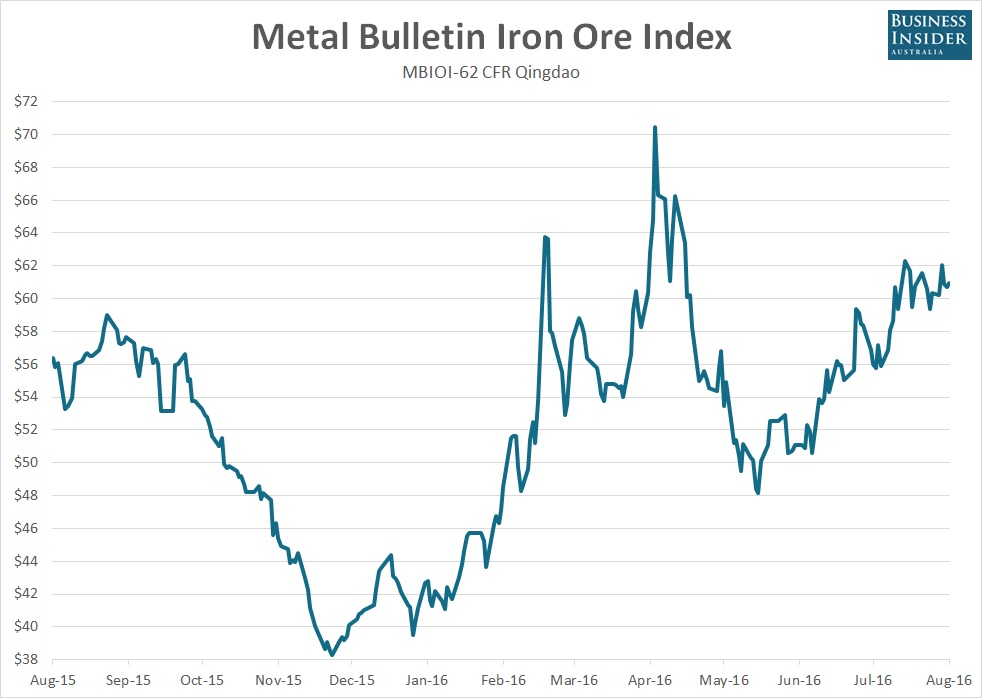

Iron ore prices rose fractionally on Friday, continuing the choppy price action seen since the start of August.

According to Metal Bulletin, the spot price for benchmark 62% fines increased by 0.4% to $60.95 a tonne, leaving its year to date gain at 39.9%.

Price for lower grade ore went the other direction with the spot price for 58% fines sliding 0.66% to $48.36 a tonne.

Suggesting that the strength in the benchmark price may continue on Monday, Dalian iron ore futures jumped on Friday evening with the most actively traded January 2017 contract on the Dalian Commodities Exchange finishing the session at 447 yuan, an increase of 2.17%.

Coking coal futures were also higher, rising 1.95% to 1,257 yuan.

Analysts at Metal Bulletin note that the move in futures corresponded with further chatter about the shuttering of obsolete coal and steel production in China.

“Liaoning’s provincial government said on Thursday that the province would cut crude steel production capacity by 6.02 million tonnes by the end of this year. It also plans to reduce coal production capacity by 30.4 million tonnes by 2020,” said Metal Bulletin.

“The province has cut steel production capacity by 2.1 million tonnes during the first half of the year – 35% of its target for this year,” it added.

Despite the lift in iron ore and coking coal futures, Chinese rebar futures traded on the Shanghai futures exchange slid, closing the session down 0.11% at 2,575 yuan.

Trade in all three contracts will resume at 11am AEST.