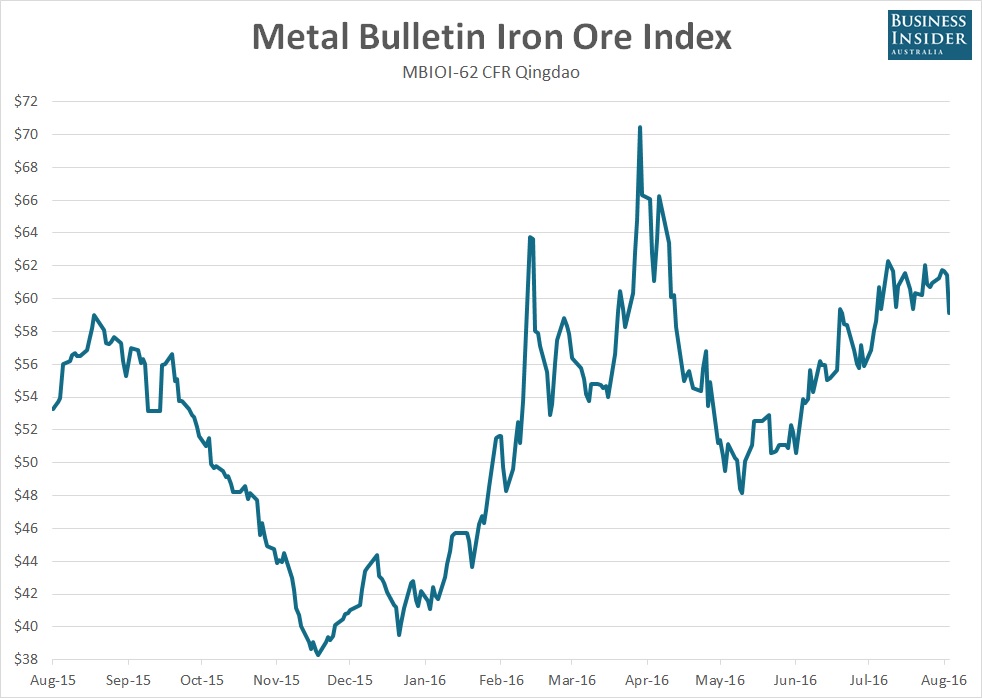

Iron ore prices tumbled on Friday, closing the session at the lowest level seen since late July.

According to Metal Bulletin, the spot price for benchmark 62% fines slid by 3.76% to $59.13 a tonne, trimming its year to date gain to 35.7%.

It was the largest percentage decline since June 14, and the lowest close seen since July 27.

Analysts at Metal Bulletin noted that the fall corresponded with weakness in Chinese rebar prices. They also noted that activity in the market was “limited” with sellers “reportedly lowering offers”.

Vivek Dhar, a mining and energy commodities analyst at the Commonwealth Bank, wrote on Monday morning that the decline was partly fueled by expectations for further weakness ahead.

“Chinese buyers held off in anticipation of further iron ore price declines,” he says. “Some buyers also sourced cheaper iron ore from port stockpiles due to the recent volatility in iron ore prices. China’s iron ore port stocks reportedly fell by 1.0 Mt [million tonnes] to 105.4 Mt last week.”

Whether due to expectations for further declines or other factors, the sharp and sudden move looks set to continue on Monday, at least based upon the price action seen in Chinese iron ore futures.

The most actively traded January 2016 contract on the Dalian Commodities Exchange last traded at 420 yuan on Friday evening, down 3.67% on the previous closing level.

If sustained or built upon today, it points to the likelihood of weakness in spot markets arriving later in the session.

Trade in Dalian will resume at 11am AEST.