Tata Steel’s UK arm sank into the red last year, racking up a loss of nearly £600m before tax as the company was hit by low steel prices, large writedowns and redundancy costs.

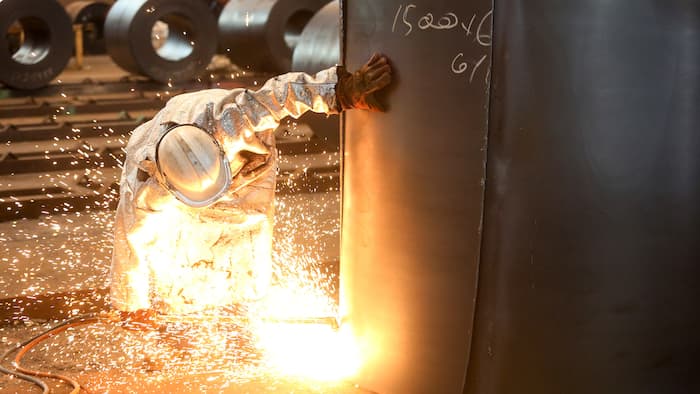

Britain’s biggest steelmaker was plunged into turmoil after it was put up for sale by its Indian owner in spring, sparking fears for the future of the legacy business.

Its financial difficulties were illustrated by a pre-tax loss of £599m in the year to 31 March, according to the latest company accounts. The deficit was almost two-fifths wider than that recorded for the same operations in the previous financial year after adjusting for disposals.

At one point the company, centred on the giant Port Talbot plant in south Wales, was said to be haemorrhaging up to £1m a day as a global steel glut and cheap imports from China rocked western steel producers.

The grave extent of the UK steel crisis — which claimed some 5,000 direct jobs and more in the supply chain — was underlined when Tata described its British operation as almost worthless.

It has since sold its Scunthorpe steelworks and also offloaded two smaller mills in Scotland. Excluding the impact of those disposals, revenue at the rump business dropped by more than one-fifth to £2.26bn — due to lower steel prices and a decision to cut production and make more valuable forms of the metal.

Tata Steel’s decision to withdraw from the UK, where it employs 11,000 people at factories throughout Wales, northern England and the Midlands, prompted the government to offer a part-nationalisation and hundreds of millions of pounds in loans to a potential buyer in a desperate bid to avert meltdown in the ailing sector.

But the Indian group changed tack in July, announcing it was in talks over a possible merger of its European steel business with that of German rival ThyssenKrupp.

Before any deal can conclude Tata must find a resolution to a £15bn pension scheme, which is seen as a burden on the business. There are fears among workers that Port Talbot could be the target of cutbacks in a combined entity.

Despite last year’s poor financial results, employees at the south Wales plant say it is now making a small profit as a painful restructuring that saw 750 people laid off in January bears fruit. It has been aided by a rise in steel prices, coupled with the devaluation of sterling since the EU referendum which has made British manufactured goods more competitive.

Tata said that trading had been positive in the first quarter, leading to an improved outlook for the rest of the year.

However, the company’s longer-term prospects were laid out starkly in a note accompanying the accounts. This said that while directors had a reasonable expectation that the company had adequate resources to continuing operating for the foreseeable future, there existed a “material uncertainty which may cast significant doubt on [its] ability to continue as a going concern”.

A sales process remains under way for Tata’s speciality steels unit in South Yorkshire and a site in Hartlepool that produces pipeline tubes.

Tata Steel UK booked total charges of £959m in the financial year, including a large writedown on the value of property and equipment, which wiped out a similar sized gain from its pension scheme. Greater debts to its parent led total borrowings to increase more than 40 per cent to £3.06bn.